Chart Pattern Recognition Software Metastock Reviews

Dec 23, 2002. Cool new toys for MetaStock. MetaStock has a huge arsenal of analysis and charting tools that can keep any technical analyst happy. Much of the power of. Another plug-in is John Murphy's Chart Pattern Recognition system, which can scan through security-pricing data searching for specific patterns.

Originally presented on 12/11/14 by Hunter Smith Hidden inside every chart is a story - a story about where the price has been and where it might go in the future. Some stories are obvious. Others are a little more difficult to figure out. These stories are told with patterns.

Chart patterns are simply defined as pictures or formations made by the price movements of the stocks or commodities you're examining. Numerous studies have repeatedly shown that these patterns have excellent predictive value. Now you can take advantage of the experience and insight of John Murphy, one of the world's foremost financial analysts, to help take the subjective guesswork out of identifying these classic patterns. Hunter Smith from MetaStock will show you how to use the John Murphy Chart Pattern Recognition Add-on for MetaStock to identify reversal and continuation patters such as: Head and Shoulders Triple Tops and Bottoms Double Tops and Bottoms Symmetrical, Ascending, and Descending Triangles About Hunter Smith Hunter Smith works in the MetaStock Sales department and uses his knowledge to help MetaStock customers find the best products to suit them. Hunter has presented at many MetaStock webinars and at TradeShows and loves to share his knowledge on MetaStock Products.

The traditional chartist relies on visual interpretation. Technical Analysis of the Financial Markets. Chart patterns are 'visual. Human emotion and subjectivity are enemies to the statistical technician. Sophisticated computer software has evolved over the last two decades that allows any aspiring technician. Confusion leads to poor decisions. Chart patterns are 'visual. Sophisticated computer software has evolved over the last two decades that allows any aspiring technician to hit the ground running full-speed. Often we refer to technical analysis as an 'art' rather than an exact science. And the old school teaches.

Contents • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • History The principles of technical analysis are derived from hundreds of years of data. Some aspects of technical analysis began to appear in Amsterdam-based businessman 's accounts of the Dutch financial markets in the 17th century. In Asia, technical analysis is said to be a method developed by during the early 18th century which evolved into the use of, and is today a technical analysis charting tool. In the 1920s and 1930s Richard W. Schabacker published several books which continued the work of and in their books Stock Market Theory and Practice and Technical Market Analysis. In 1948 Robert D. Edwards and John Magee published Technical Analysis of Stock Trends which is widely considered to be one of the seminal works of the discipline.

It is exclusively concerned with trend analysis and chart patterns and remains in use to the present. Early technical analysis was almost exclusively the analysis of charts, because the processing power of computers was not available for the modern degree of statistical analysis. Charles Dow reportedly originated a form of analysis. Is based on the collected writings of co-founder and editor Charles Dow, and inspired the use and development of modern technical analysis at the end of the 19th century. Reine Sobre Mim Download Dublado Rmvb. Other pioneers of analysis techniques include, and who developed their respective techniques in the early 20th century.

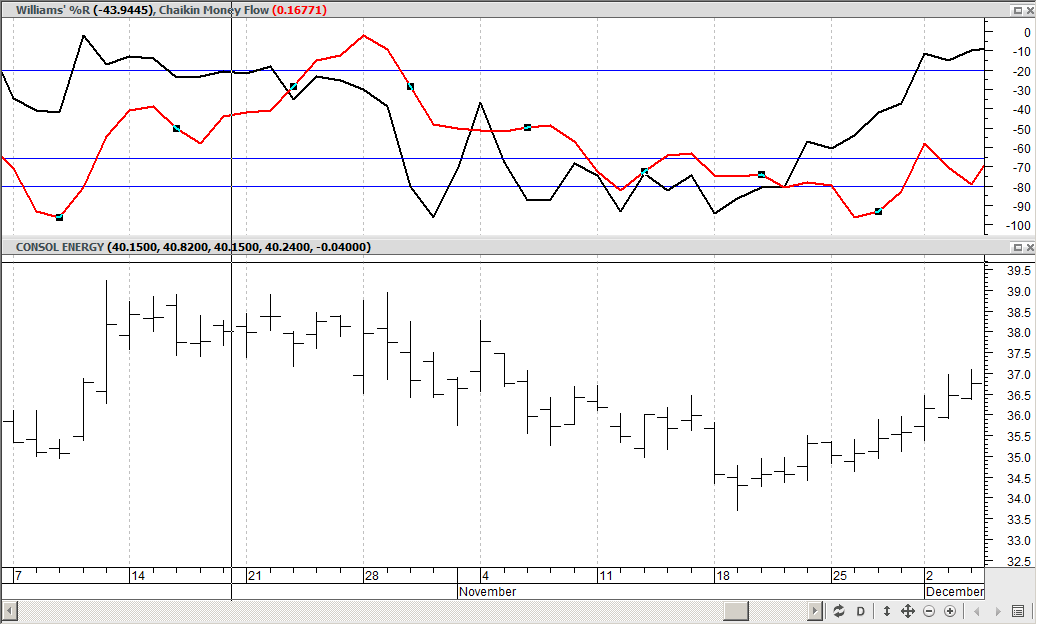

More technical tools and theories have been developed and enhanced in recent decades, with an increasing emphasis on computer-assisted techniques using specially designed computer software. General description Fundamental analysts examine earnings, dividends, assets, quality, ratio, new products, research and the like. Technicians employ many methods, tools and techniques as well, one of which is the use of charts. Using charts, technical analysts seek to identify price patterns and in financial markets and attempt to exploit those patterns. Technicians using charts search for archetypal price chart patterns, such as the well-known or reversal patterns, study,, and look for forms such as lines of support, resistance, channels, and more obscure formations such as,, balance days and patterns. Technical analysts also widely use market indicators of many sorts, some of which are mathematical transformations of price, often including up and down volume, advance/decline data and other inputs.